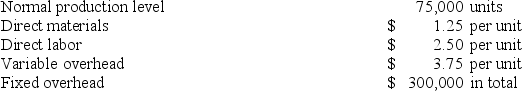

Swola Company reports the following annual cost data for its single product.  This product is normally sold for $25 per unit.If Swola increases its production to 200,000 units,while sales remain at the current 75,000 unit level,by how much would the company's income increase or decrease under variable costing?

This product is normally sold for $25 per unit.If Swola increases its production to 200,000 units,while sales remain at the current 75,000 unit level,by how much would the company's income increase or decrease under variable costing?

Definitions:

FICA Tax

A federal tax in the United States that funds Social Security and Medicare, required to be paid by both employees and employers.

Federal Unemployment Tax

A federal levy paid by employers to fund the unemployment account of the federal government, used to pay unemployment benefits to workers who have lost jobs.

State Unemployment Tax

A tax imposed by state governments on employers to fund unemployment insurance benefits for workers who have lost their jobs.

Social Security Tax

Taxes collected to fund the Social Security program, providing benefits for retirees, the disabled, and survivors of deceased workers.

Q33: A variable costing income statement focuses attention

Q74: The sales budget for Modesto Corp.shows that

Q80: A plan that lists dollar amounts to

Q84: The sales budget comes from a careful

Q186: Using absorption costing,which of the following manufacturing

Q191: Income under absorption costing will always be

Q192: Compute the contribution margin ratio.<br>A)40.0%.<br>B)66.7%.<br>C)20.7%.<br>D)50.0%.<br>E)19.3%.

Q204: Clevenger Co.planned to produce and sell 30,000

Q215: Ruiz Co.'s budget includes the following credit

Q218: Selected information from Richards Company's flexible budget