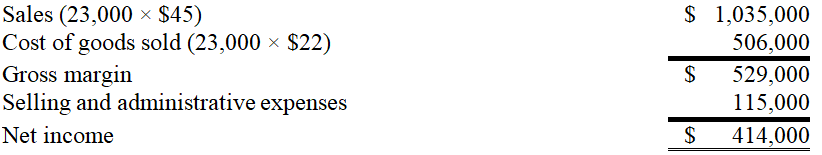

Fields Cutlery,a manufacturer of gourmet knife sets,produced 20,000 sets and sold 23,000 units during the current year.Beginning inventory under absorption costing consisted of 3,000 units valued at $66,000 (Direct materials $12 per unit; Direct labor,$3 per unit; Variable Overhead,$2 per unit,and Fixed overhead,$5 per unit.) All manufacturing costs have remained constant over the 2-year period.At year-end,the company reported the following income statement using absorption costing:  60% of total selling and administrative expenses are variable.Compute net income under variable costing.

60% of total selling and administrative expenses are variable.Compute net income under variable costing.

Definitions:

Populations

The entire group of individuals or items of interest from which samples may be drawn for statistical analysis.

Mean

The mean value of a group of numbers, found by dividing the aggregate of the numbers by how many numbers there are.

Difference

The result of subtracting one quantity from another, highlighting disparities or changes between them.

Random Samples

Selections made in such a way that each member of a population has an equal chance of being included in the sample.

Q37: Based on this information,the total direct labor

Q62: Compute the variable overhead spending variance. <br>A)$25,450

Q94: Western Company allocates $10 overhead to products

Q119: Red Raider Company uses a plantwide overhead

Q152: Locus Company has total fixed costs of

Q173: The master budget process usually begins with

Q194: Larger,more complex organizations usually require a longer

Q195: Compute the variable overhead cost variance. <br>A)$18,000

Q210: The more activities tracked by activity-based costing,the

Q233: A cost-volume-profit (CVP)chart is a graph that