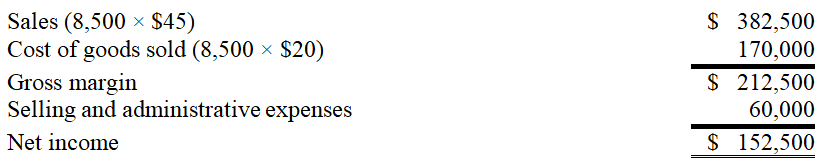

Wind Fall,a manufacturer of leaf blowers,began operations this year.During this year,the company produced 10,000 leaf blowers and sold 8,500.At year-end,the company reported the following income statement using absorption costing:  Production costs per leaf blower total $20,which consists of $16 in variable production costs and $4 in fixed production costs (based on the 10,000 units produced) .Fifteen percent of total selling and administrative expenses are variable.Compute net income under variable costing.

Production costs per leaf blower total $20,which consists of $16 in variable production costs and $4 in fixed production costs (based on the 10,000 units produced) .Fifteen percent of total selling and administrative expenses are variable.Compute net income under variable costing.

Definitions:

Subsidiaries

Companies that are controlled by a parent company through majority ownership or significant control over management decisions.

Disclosure Exemption

A provision allowing an entity to not disclose certain information that is normally required by accounting standards.

Government-related Entities

Entities that are controlled, jointly controlled or significantly influenced by a government.

Quantitative Indication

Numerical evidence or metrics that signal the performance, situation, or condition of an entity or market.

Q5: Gala Enterprises reports the following information regarding

Q14: Varigon Co.produces and sells three products-Household,Commercial,and Industrial,and

Q30: The selling price per composite unit for

Q60: The most useful budget figures are developed:<br>A)From

Q114: Todd Enterprises is preparing a cash budget

Q115: Webster Corporation's budgeted sales for February are

Q140: The sales budget is derived from the

Q158: Greco Company has prepared the following forecasts

Q167: Use the following information to prepare the

Q168: _ is the amount remaining from sales