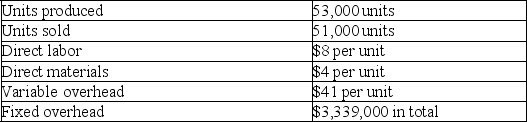

Castaway Company reports the following first year production cost information:

a.Compute production cost per unit under variable costing.

a.Compute production cost per unit under variable costing.

b.Compute production cost per unit under absorption costing.

c.Determine the cost of ending inventory using variable costing.

d.Determine the cost of ending inventory using absorption costing.

Definitions:

Commission

A service charge assessed by a broker or agent for facilitating a transaction, typically a percentage of the transaction's total value.

Merchandise

Goods or items that are available for purchase in retail, including a wide range of products from clothing to electronics.

Commission Rates

The percentage or fixed payment associated with a commission, determined by the terms of the agreement.

Net Proceeds

The amount of money that remains after all costs, expenses, and taxes have been subtracted from the total amount received from a transaction.

Q17: What are the limitations of using variable

Q23: Bioclean Co.,a merchandiser,sells a biodegradable cleaning product

Q45: What is the reason for pooling costs?<br>A)To

Q73: Compute the fixed overhead cost variance. <br>A)$18,300

Q82: The process of planning future business actions

Q111: A capital expenditures budget shows dollar amounts

Q118: The usefulness of overhead allocations based on

Q125: Overhead costs are indirect costs so assigning

Q137: Countdown Inc.sold 17,000 units of its product

Q190: The production budget cannot be prepared until