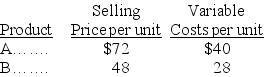

A firm sells two different products,A and B.For each unit of B sold,the firm sells two units of A.Total fixed costs $1,260,000.Additional selling prices and cost information for both products follow:

Required:

Required:

(a)Calculate the contribution margin per composite unit.

(b)Calculate the break-even point in units of each individual product.

(c)If pretax income before taxes of $294,000 is desired,how many units of A and B must be sold?

Definitions:

Optimal Capital Structure

The optimal combination of equity and debt financing that reduces the firm's capital costs to the minimum while maximizing its value.

Maximizes Value

Maximizes Value refers to the financial management principle where decisions are made to increase the worth of a company or asset to its shareholders or owners.

Financial Distress Costs

Expenses incurred by a company when it is struggling to meet its financial obligations, which may include bankruptcy costs, restructuring costs, and inefficiencies.

Financial Leverage

Leveraging borrowed capital to enhance the expected returns of an investment, thereby also magnifying the potential for loss.

Q21: How does ABC differ from using multiple

Q42: Prepare journal entries to record the following

Q82: Process costing is applied to operations with

Q92: The high-low method is used to derive

Q139: The total product cost per unit under

Q157: Which of the following is not a

Q198: During its first year of operations,the McCormick

Q213: A _ cost is one that remains

Q223: Variable costs per unit increase proportionately with

Q243: Alvarez Company's break-even point in units is