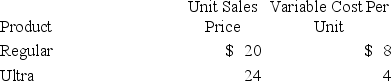

A firm sells two products,Regular and Ultra.For every unit of Regular sold,two units of Ultra are sold.The firm's total fixed costs are $1,612,000.Selling prices and cost information for both products follow.What is the firm's break-even point in units of Regular and Ultra?

Definitions:

Protective Tariff

A tariff imposed to protect domestic industries from foreign competition by increasing the cost of imported goods.

Free-Trade Zone

A designated area within a country where goods can be imported, stored, processed, and exported without the intervention of customs authorities.

North American Free Trade Agreement

An agreement signed by Canada, Mexico, and the United States, creating a trilateral trade bloc in North America aimed at reducing trading costs, increasing business investment, and helping North America be more competitive in the global marketplace.

Tariffs

Taxes imposed by a government on imported or exported goods, often used to protect domestic industries against foreign competition.

Q19: Stanley Company is preparing a cash budget

Q20: Andrews Corporation uses the weighted-average method of

Q111: Cost-volume-profit analysis is based on necessary assumptions.Which

Q117: Managers can use variable costing information for

Q156: The term "process costing system" refers to

Q180: The _ ,prepared by manufacturing firms,shows the

Q187: The budgeted income statement presented below is

Q216: A plan that shows the expected cash

Q228: Target income refers to:<br>A)Income at the break-even

Q232: A company sells a single product that