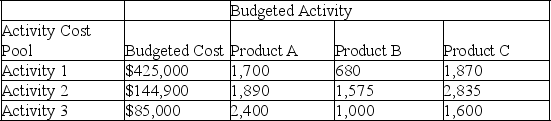

A company uses activity-based costing to determine the costs of its three products: A,B,and C.The budgeted cost and activity for each of the company's three activity cost pools are shown in the following table:

Compute the company's activity rates under activity-based costing for each of the three activities.

Compute the company's activity rates under activity-based costing for each of the three activities.

Definitions:

Production Process

A set of operational activities and tasks involved in the conversion of raw materials into finished products or services.

Local Iron Ore

Iron ore mined within a specific geographic area, typically used in steel production within the same region to reduce transportation costs and support local industries.

Cradle to Cradle

A design philosophy that encourages the creation of products with lifecycle considerations, aiming for sustainability and minimal environmental impact.

Landfill Inventory

The accumulated waste material that is stored in a designated disposal site, typically managed to minimize its impact on the environment.

Q4: What are the activity rates for the

Q9: Equivalent units of production are always the

Q19: Activities are the cost objects of the

Q45: What is the reason for pooling costs?<br>A)To

Q126: The journal entry to record the allocation

Q155: Calculate the cost per equivalent unit of

Q188: A manufacturing company applies overhead using direct

Q188: A major disadvantage of using a plantwide

Q205: The usefulness of overhead allocations based on

Q217: Process costing systems are commonly used by