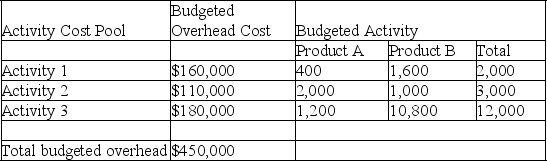

A company has two products: A and B.It uses activity-based costing and has prepared the following analysis showing budgeted costs and activities.Use this information to compute (a)the company's overhead rates for each of the three activities and (b)the amount of overhead allocated to Product A.

Definitions:

Amortization Of Tangible Capital Assets

The systematic reduction in the value of physical assets of a company over their useful lives for accounting and tax purposes.

Statement Of Changes

A detailed financial statement showing the changes in equity of a company over a certain period of time, including transactions with shareholders and the result of profits or losses.

Net Debt

A metric that subtracts total liabilities from cash and cash equivalents, measuring a company's ability to pay off its debts with its liquid assets.

Public Sector Accounting Board

A regulatory body responsible for setting and issuing accounting standards and guidance for the public sector.

Q7: Calculate the cost per equivalent unit of

Q75: During March,the production department of a process

Q85: A _ accounting system accumulates production costs

Q93: The ending inventory of finished goods has

Q97: Under absorption costing,fixed overhead costs are excluded

Q109: The _ is the target of the

Q119: Calculate the equivalent units of conversion.<br>A)250,000<br>B)317,000<br>C)294,000<br>D)333,000<br>E)342,000

Q129: The journal entry to record June production

Q156: The term "process costing system" refers to

Q199: An important assumption in multiproduct CVP analysis