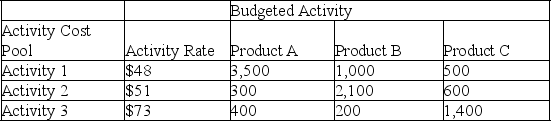

A company uses activity-based costing to determine the costs of its three products: A,B and C.The activity rates and activity levels for each of the company's three activity cost pools are shown in the following table:

Compute the company's budgeted overhead cost for each of the three products under activity-based costing.

Compute the company's budgeted overhead cost for each of the three products under activity-based costing.

Definitions:

Accumulates Costs

The process of gathering, recording, and classifying expenses incurred in the production of goods or services, crucial for determining product pricing and profitability.

Time Periods

Defined durations or intervals of time, often used for financial reporting, project phases, or historical analysis.

Job Costing

A method of costing that assigns costs directly to specific jobs or projects, commonly used in industries like construction and consulting.

Specialty Manufacturing

The production of goods in specialized areas, often involving unique or high-quality products.

Q25: Production of one unit of Product BJM

Q37: Departments are the cost objects when the

Q65: A cost that changes in total in

Q143: The following is an account for a

Q145: A product is sold for $45 and

Q156: A company's ending inventory of finished goods

Q165: The predetermined overhead rate for Shilling Manufacturing

Q174: Castaway Company reports the following first year

Q181: A product sells for $200 per unit,and

Q216: A company produces computer chips that go