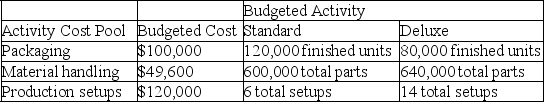

Bark Mode,Incorporated produces and distributes two types of security systems,Standard and Deluxe.Budgeted cost and activity for each of its three activity cost pools are shown below.

The company plans to produce and sell 120,000 standard units and 80,000 deluxe units.

a.Compute the approximate overhead cost per unit of standard under activity-based costing.

a.Compute the approximate overhead cost per unit of standard under activity-based costing.

b.Compute the approximate overhead cost per unit of deluxe under activity-based costing.

Definitions:

Straight-Line Method

An approach for calculating depreciation of an asset, which spreads the cost evenly over its useful life.

Depreciation

A process for spreading out the expense of a physical asset across its lifespan.

Residual Value

The estimated value that an asset will realize upon its sale at the end of its useful life.

Straight-Line Depreciation

A method of calculating the depreciation of an asset, distributing its cost evenly across its useful life.

Q10: Equivalent units of production is the number

Q14: In process costing,a _ is used to

Q24: Whiting Company sells a mix of three

Q29: The following information is available for a

Q50: Booth Manufacturing uses a job order costing

Q58: Managerial accounting provides financial and nonfinancial information

Q58: Process costing systems use a single Work

Q170: Wrap-It Company,a manufacturer of wrapping paper,began operations

Q198: McCoy Brothers manufactures and sells two products,A

Q211: Leeks Company's product has a contribution margin