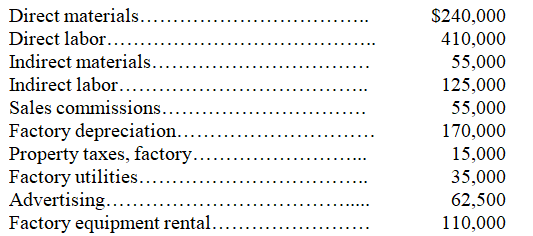

The predetermined overhead rate for Foster,Inc.,is based on estimated direct labor costs of $400,000 and estimated factory overhead of $500,000.Actual costs incurred were: (a)Calculate the predetermined overhead rate and calculate the overhead applied during the year.

(a)Calculate the predetermined overhead rate and calculate the overhead applied during the year.

(b)Prepare the journal entry to eliminate the over- or underapplied overhead,assuming that it is not material in amount.

Definitions:

After-tax Cost

The expense of an action or transaction after considering the impact of taxes.

Dividend

A distribution of a portion of a company's earnings, decided by the board of directors, to a class of its shareholders.

Growth Rate

The percentage increase in a company's revenue or earnings from one period to the next, demonstrating how quickly it is expanding.

Market Price

The amount for which something can be sold on a given market at a specific point in time.

Q13: External users of accounting information make the

Q13: Compute the ending work in process inventory

Q81: Net income divided by average total assets

Q109: Luker Corporation uses a process costing system.The

Q154: If the predetermined overhead allocation rate is

Q160: If a process has _ or _

Q174: Three of the most common tools of

Q189: Beginning finished goods inventory plus cost of

Q204: A _ is a collection of costs

Q238: A company's prime costs total $4,500,000 and