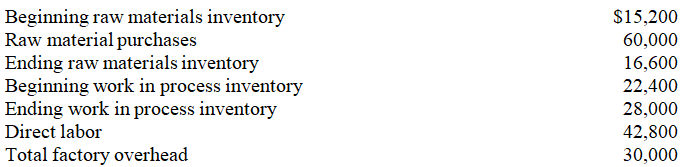

Current information for the Healey Company follows:  All raw materials used were traceable to specific units of product.

All raw materials used were traceable to specific units of product.

-Healey Company's total manufacturing costs for the year are:

Definitions:

Deferred Income Taxes

Taxes applicable to income that is recognized in the financial statements in one period but is taxable in another.

Income Taxes Payable

The amount of income taxes a company owes to the government that has not yet been paid.

Income Tax Expense

The total amount of income tax a company is obligated to pay to tax authorities, reported in its financial statements.

Retained Earnings Account

A component of shareholders' equity that represents the accumulated portion of net income that a company has not distributed to shareholders as dividends.

Q14: If actual overhead incurred during a period

Q21: A company's income statement showed the following:

Q24: An employee overstates his reimbursable expenses in

Q38: The ability to generate future revenues and

Q71: A company had average total assets of

Q84: Use the following information from the current

Q91: A cost can be classified as either

Q152: Dallas Company uses a job order costing

Q191: During November,the production department of a process

Q244: Compute the company's profit margin for Year