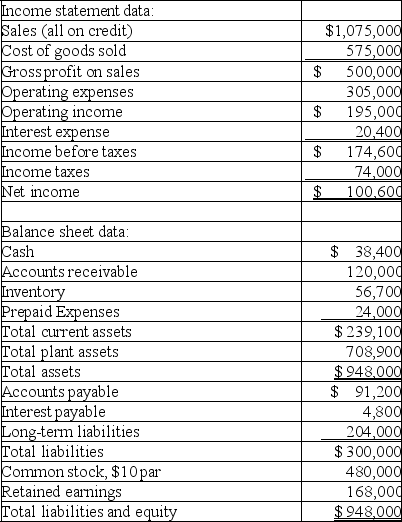

Use the following information from the current year financial statements of a company to calculate the ratios below:

(a)Current ratio.

(b)Accounts receivable turnover.(Assume the prior year's accounts receivable balance was $100,000.)

(c)Days' sales uncollected.

(d)Inventory turnover.(Assume the prior year's inventory was $50,200.)

(e)Times interest earned ratio.

(f)Return on common stockholders' equity.(Assume the prior year's common stock balance was $480,000 and the retained earnings balance was $128,000.)

(g)Earnings per share (assuming the corporation only has common stock outstanding).

(h)Price earnings ratio.(Assume the company's stock is selling for $26 per share.)

(i)Divided yield ratio.(Assume that the company paid $1.25 per share in cash dividends.)

Definitions:

Confidence Interval

A range of values derived from sample data that is likely to contain the value of an unknown population parameter, with a certain level of confidence.

Retained Students

Students who have not progressed to the next academic grade or level as expected, often due to academic or other challenges.

Significance Level

A threshold for determining the probability of rejecting the null hypothesis in a statistical test, typically set before the data is collected.

Sample Data

A subset of data collected from a larger population, used for statistical analysis.

Q1: An example of a guideline (or rule

Q45: What does the days' sales in raw

Q70: Comparative calendar year financial data for a

Q100: All of the following statements related to

Q101: A manufacturing firm's cost of goods manufactured

Q106: The main difference between the cost of

Q107: For each of the following independent transactions

Q125: Victoria reported assets of $13,362 million at

Q140: The dividend yield is computed by dividing:<br>A)Annual

Q238: Net income divided by net sales is