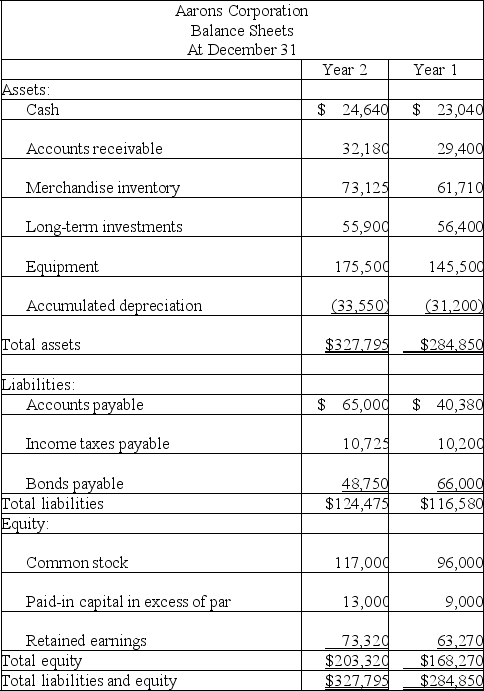

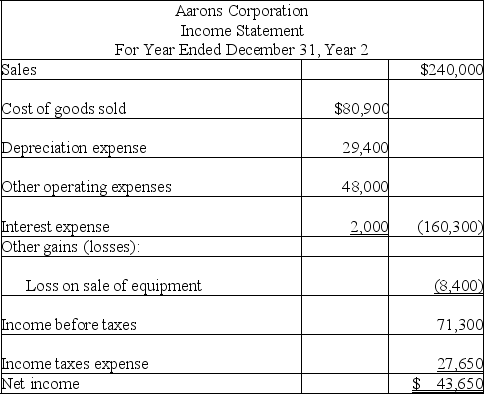

The following information is available for the Aarons Corporation:

Additional information:

Additional information:

(1)There was no gain or loss on the sales of the long-term investments,nor on the bonds retired.

(2)Old equipment with an original cost of $37,550 was sold for $2,100 cash.

(3)New equipment was purchased for $67,550 cash.

(4)Cash dividends of $33,600 were paid.

(5)Additional shares of stock were issued for cash.

Prepare a complete statement of cash flows for Year 2 using the indirect method.

Definitions:

Biological Fitness

A measure of an organism's ability to survive and reproduce in its environment, often influenced by genetic traits.

Diabetes

A metabolic disorder characterized by high blood sugar levels over a prolonged period, resulting from insulin production issues or cell response.

Lactose Tolerance

The ability of adults to digest lactose, a sugar found in milk, due to the continued activity of the enzyme lactase.

Social Nature

The inherent inclination of humans to seek connections and interactions with others, forming communities and societies.

Q12: Use the following information about the current

Q19: Shemekia Co.produces seats for movie theaters.Listed below

Q34: The debt-to-equity ratio:<br>A)Is calculated by dividing book

Q106: Ron Landscaping's income statement reports net income

Q110: On January 1,the Rodrigues Corporation leased some

Q123: A stock split can be done in

Q138: Earnings per share is calculated using income

Q172: The cash flows from operating activities section

Q220: A stock split is the distribution of

Q248: Costs necessary and integral to the manufacture