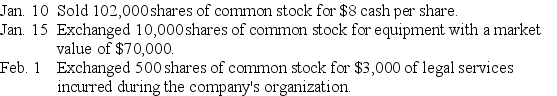

A company is authorized to issue 750,000 shares of $2 par value common stock.Prepare journal entries to record the following selected transactions that occurred during the company's first year of operations:

Definitions:

Buyer Pays

A pricing term indicating that the purchaser is responsible for the cost of goods, shipping, and any additional expenses associated with the purchase.

Tax Incidence

Describes how the burden of a tax is distributed between buyers and sellers, depending on the relative elasticities of supply and demand.

Levied On

Imposed or applied, typically in the context of taxes or duties on goods, services, or income.

Seller Bears

Refers to situations where the seller is responsible for costs or burdens, such as during the transaction of goods where the seller pays for shipping or returns.

Q93: Net cash provided by operating activities was:<br>A)$120,000.<br>B)$60,000.<br>C)$70,000.<br>D)$80,000.<br>E)$130,000.

Q104: A liability is a probable future payment

Q117: A company's debt-to-equity ratio was 1.0 at

Q152: The _ method of amortizing a bond

Q156: The Discount on Common Stock account reflects:<br>A)The

Q160: The journal entry to record the issuance

Q183: Mayan Company had net income of $132,000.The

Q184: A _ is a written promise to

Q193: General Co.entered into the following transactions involving

Q213: A _ is a potential obligation that