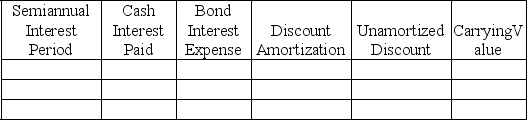

A company issued 10%,10-year bonds with a par value of $1,000,000 on January 1,at a selling price of $885,295 when the annual market interest rate was 12%.The company uses the effective interest amortization method.Interest is paid semiannually each June 30 and December 31.

(1)Prepare an amortization table for the first two payment periods using the format shown below:

(2)Prepare the journal entry to record the first semiannual interest payment.

(2)Prepare the journal entry to record the first semiannual interest payment.

Definitions:

Deductibility

Deductibility refers to the eligibility of an expense to be subtracted from gross income to reduce taxable income, based on IRS guidelines.

Schedule C

A form used by sole proprietors to report income and expenses from a business or profession to the IRS.

Schedule E

A form used with the Form 1040 for reporting income from rental property, royalties, partnerships, S corporations, estates, trusts, and residual interests.

Tax Purposes

Criteria or activities specifically considered or accounted for in the calculation or management of taxes.

Q37: The bonds' future cash flows include the

Q56: Use the information provided below to calculate

Q73: A company issued 10-year,9% bonds,with a par

Q88: A company purchased and installed machinery on

Q104: Parlay Corporation has 2,000,000 shares of $0.50

Q105: Martinez owns an asset that cost $87,000

Q160: One characteristic of plant assets is that

Q202: Describe the journal entries required to record

Q204: On April 1,2015,due to obsolescence resulting from

Q217: Collateral from unsecured loans may be sold