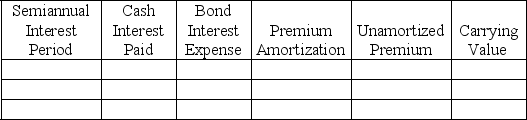

A company issued 10%,5-year bonds with a par value of $2,000,000,on January 1.Interest is to be paid semiannually each June 30 and December 31.The bonds were sold at $2,162,290 based on an annual market rate of 8%.The company uses the effective interest method of amortization.

(1)Prepare an amortization table for the first two semiannual payment periods using the format shown below.

(2)Prepare the journal entry to record the first semiannual interest payment.

(2)Prepare the journal entry to record the first semiannual interest payment.

Definitions:

Reverse Engineering

The process of deconstructing a man-made object in order to reveal its designs, architecture, or to extract knowledge from the object.

Trade Secret

A process, product, method of operation, or compilation of information that gives a businessperson an advantage over his or her competitors.

Possessory Interest

A legal right or interest in tangible or intangible property granting the holder physical control or exclusive use.

Estate

An individual's net worth, including all property, assets, and liabilities left behind at death.

Q10: The effective interest method assigns a bond

Q38: Explain in detail how to compute each

Q44: A premium on bonds occurs when bonds

Q82: Once an asset's book value equals its

Q108: A main purpose of the statement of

Q126: On December 1,Watson Enterprises signed a $24,000,60-day,4%

Q152: Springfield Company offers a bonus plan to

Q175: A plant asset's useful life is the

Q176: Stock that was reacquired and is still

Q185: The Wage and Tax Statement given to