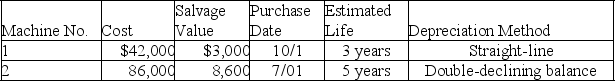

A company's property records revealed the following information about its plant assets:

Calculate the depreciation expense for each machine in Year 1 and Year 2 for the year ended December 31.

Calculate the depreciation expense for each machine in Year 1 and Year 2 for the year ended December 31.

Definitions:

Statutory Tax Rate

The tax rate prescribed by law that applies to income, sales, or other taxable activities.

Effective Tax Rate

The mean rate at which a person or company pays taxes, determined by dividing the total amount of tax paid by the taxable earnings.

Tax Planning

The analysis and arrangements of a financial situation or business to minimize tax liability.

IFRS

International Financial Reporting Standards, a set of accounting standards developed by the International Accounting Standards Board (IASB) for international use.

Q90: Which of the following is not true

Q148: Employer payroll taxes:<br>A)Are added expenses beyond that

Q154: Additions to land that increase the usefulness

Q160: Belkin Co.provides medical care and insurance benefits

Q172: The treasurer of a company is responsible

Q173: The amount of interest that Jasper

Q188: A company traded an old forklift for

Q203: If a check correctly written and paid

Q215: Using the allowance method for bad debts,the

Q223: Total asset cost plus depreciation expense equals