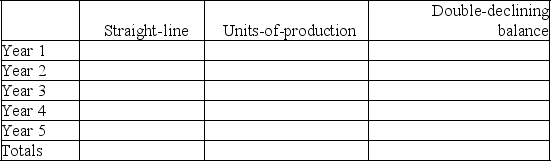

A company purchased a machine on January 1 of the current year for $750,000.Calculate the annual depreciation expense for each year of the machine's life (estimated at 5 years or 20,000 hours,with a salvage value of $75,000)using each of the below-mentioned methods.During the machine's 5-year life its hourly usage was: 3,000; 4,000; 5,000; 5,000; and 3,000 hours.

Definitions:

Tradable Emissions Permits

Rights to emit a specific amount of a pollutant that can be bought and sold, used as a market-based approach to controlling pollution.

Supply and Demand

Supply and demand are economic principles describing the relationship between the quantity of a commodity available and the quantity that consumers are willing and able to purchase.

Permit Price

The cost associated with acquiring a license or permit to engage in a certain activity or operation, often seen in environmental regulations or zoning laws.

Tradable Emissions Permits

Market-based allowances to emit a certain amount of pollution, which companies can buy or sell depending on their need to emit more or less than their allocation.

Q19: Kelso had income before interest expense and

Q49: If a 60-day note receivable is dated

Q83: On June 1,Jasper Company signed a $25,000,120-day,6%

Q100: Craigmont uses the allowance method to account

Q106: If land is purchased as a building

Q125: A company's property records revealed the following

Q131: Depreciation does not measure the decline in

Q171: Zhang Co.uses a voucher system for documentation

Q202: The following information is available for the

Q219: Trey Morgan is an employee who is