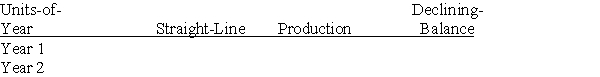

A machine costing $450,000 with a 4-year life and an estimated salvage value of $30,000 is installed by Peters Company on January 1.The company estimates the machine will produce 1,050,000 units of product during its life.It actually produces the following units for the first 2 years: Year 1,260,000; Year 2,275,000.Enter the depreciation amounts for years 1 and 2 in the table below for each depreciation method.Show calculation of amounts below the table.

Double

Definitions:

Buses Versus Rail Systems

A comparison of the efficiency, cost, and environmental impact of using buses or rail systems as modes of public transportation.

Mass Transportation

Systems designed to move large numbers of people efficiently within urban and suburban areas, including buses, trains, subways, and trams.

Traffic Problems

Issues related to the congestion and management of vehicles on roadways, affecting travel time and safety.

Decibels

A unit of measurement used to express the intensity of sound, symbolized as dB.

Q7: What entry should be made on the

Q40: A purchase order is a document the

Q80: Preparing a bank reconciliation on a monthly

Q130: A machine had an original cost of

Q156: During August,Boxer Company sells $356,000 in merchandise

Q168: Merchant Company purchased property for a building

Q169: _ bonds have an option exercisable by

Q172: Vacation benefits is an example of a

Q205: What is the accounts receivable turnover ratio?

Q225: Additional costs of plant assets that provide