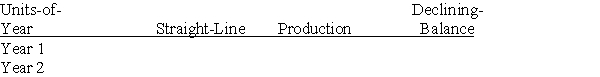

A machine costing $450,000 with a 4-year life and an estimated salvage value of $30,000 is installed by Peters Company on January 1.The company estimates the machine will produce 1,050,000 units of product during its life.It actually produces the following units for the first 2 years: Year 1,260,000; Year 2,275,000.Enter the depreciation amounts for years 1 and 2 in the table below for each depreciation method.Show calculation of amounts below the table.

Double

Definitions:

Issuing Company

A corporation that has put into circulations its shares or bonds to raise capital by selling those securities to investors.

Legal Liabilities

Obligations arising from laws or regulations that a company is required to pay, such as fines, settlements, or judgments.

Sick Pay Payable

A liability account that represents the amount of sick pay owed to employees but has not yet been paid.

Notes Payable

Liabilities representing amounts borrowed by a company that must be repaid, often with interest, as evidenced by a promissory note.

Q10: On a bank statement,deposits are shown as

Q16: The machine's useful life is estimated to

Q50: Deposits of amounts payable to the federal

Q116: On November 1,Alan Company signed a 120-day,8%

Q146: Floral Depot's income before interest expense and

Q158: The rate that a state assigns reflecting

Q185: A Company had net sales of $23,000,and

Q194: A company had interest expense of $5,000,income

Q203: If a check correctly written and paid

Q205: Goods in transit are automatically included in