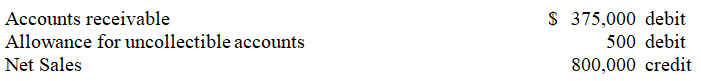

A company uses the percent of sales method to determine its bad debts expense.At the end of the current year,the company's unadjusted trial balance reported the following selected amounts:  All sales are made on credit.Based on past experience,the company estimates 0.6% of net credit sales to be uncollectible.What adjusting entry should the company make at the end of the current year to record its estimated bad debts expense?

All sales are made on credit.Based on past experience,the company estimates 0.6% of net credit sales to be uncollectible.What adjusting entry should the company make at the end of the current year to record its estimated bad debts expense?

Definitions:

Price Variance

The difference between the actual cost of a good or service and its budgeted or standard cost.

Standard Price

The pre-determined cost that a company expects to pay for goods and services.

Flexible Budget

A budget that adjusts or flexes with changes in volume or activity levels, providing a more accurate comparison of actual to budgeted expenses.

Operating Period

This term describes the span of time during which a business operates or performs its principal activities, often measured in fiscal quarters or years.

Q4: The cost of an intangible asset is

Q47: Decision makers and other users of financial

Q116: Perfection Company had cost of goods sold

Q157: The quality of receivables refers to the

Q158: Having external auditors test the company's financial

Q161: The_ method of accounting for bad debts

Q188: If a customer owes interest on accounts

Q190: The relevant factors in computing depreciation do

Q191: Determine the cost assigned to ending inventory

Q193: The depreciation method that charges the same