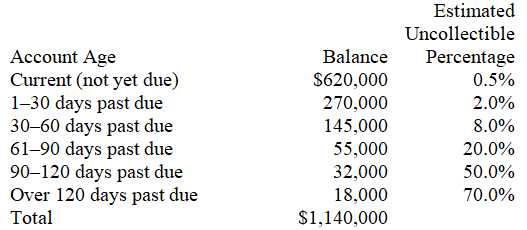

A company uses the aging of accounts receivable method to estimate its bad debts expense.On December 31 of the current year an aging analysis of accounts receivable revealed the following:

Required:

a.Calculate the amount of the Allowance for Doubtful Accounts that should be reported on the current year-end balance sheet.

b.Calculate the amount of the Bad Debts Expense that should be reported on the current year's income statement,assuming that the credit balance of the Allowance for Doubtful Accounts on January 1 of the current year was $41,000 and that accounts receivable written off during the current year totaled $43,200.

c.Prepare the adjusting entry to record bad debts expense on December 31 of the current year.

d.Show how Accounts Receivable will appear on the current year-end balance sheet as of December 31.

Definitions:

Professional Affiliation

Membership or association with a formally recognized group or organization related to one's profession or interests.

Scale of Measurement

A system of defining and categorizing the properties of variables, often used in research to quantify data.

Cognitive Ability Test

An assessment designed to measure an individual's mental capacity, including memory, reasoning, understanding, and problem-solving skills.

Standard Error

A statistical term that describes the standard deviation of the sampling distribution of a statistic, often used to measure the accuracy with which a sample represents a population.

Q37: On a bank reconciliation,the amount of an

Q91: A supplementary record created to maintain a

Q126: On October 12 of the current year,a

Q165: The _ account is used to record

Q177: Crestfield leases office space.On January 3,the company

Q178: The unadjusted trial balance at year-end for

Q192: The journal entry to record the reimbursement

Q219: Depletion is the process of allocating the

Q229: A company had beginning inventory of 10

Q249: Total asset turnover is calculated by dividing