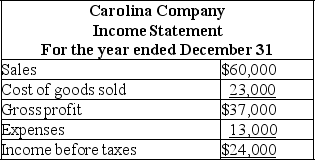

Carolina Company uses the perpetual LIFO method for valuing its ending inventory.The following financial statement information is available for its first year of operation:

Carolina's ending inventory using the perpetual LIFO method was $8,700.Carolina's accountant determined that had the company used perpetual FIFO,the ending inventory would have been $9,100.

Carolina's ending inventory using the perpetual LIFO method was $8,700.Carolina's accountant determined that had the company used perpetual FIFO,the ending inventory would have been $9,100.

a.Determine what the income before taxes would have been,had Carolina used the FIFO method of inventory valuation instead of LIFO.

b.What would be the difference in income taxes between LIFO and FIFO,assuming a 30% tax rate?

c.If Carolina wanted to lower the amount of income taxes to be paid,which method would it choose?

Definitions:

Financing

The act of providing funds for business activities, making purchases, or investing, either through debt, equity, or other financial instruments.

Dual Effects Concept

The principle that every transaction has at least two effects on the financial statements - one that increases a category and another that decreases another category, maintaining the balance.

Transaction

An event or activity that impacts the financial position of a company, typically involving the exchange of goods, services, or money.

Q29: Jepson uses the periodic inventory system and

Q50: Explain the options a company may use

Q65: A company's quick assets are $147,000 and

Q67: A company's cost of inventory was $219,500.Due

Q123: A wholesaler buys products from manufacturers or

Q123: Frederick Company borrows $63,000 from First City

Q143: A bank reconciliation explains any differences between

Q147: A company's total cost of FIFO inventory

Q172: Sales less sales discounts,less sales returns and

Q351: A company's month-end adjusting entry for Insurance