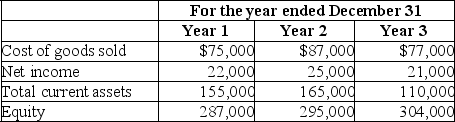

The Community Store reported the following amounts on their financial statements for Year 1,Year 2,and Year 3:

It was discovered early in Year 4 that the ending inventory on December 31,Year 1 was overstated by $6,000,and the ending inventory on December 31,Year 2 was understated by $2,500.The ending inventory on December 31,Year 3 was correct.Ignoring income taxes determine the correct amounts of cost of goods sold,net income,total current assets,and equity for each of the years Year 1,Year 2,and Year 3.

It was discovered early in Year 4 that the ending inventory on December 31,Year 1 was overstated by $6,000,and the ending inventory on December 31,Year 2 was understated by $2,500.The ending inventory on December 31,Year 3 was correct.Ignoring income taxes determine the correct amounts of cost of goods sold,net income,total current assets,and equity for each of the years Year 1,Year 2,and Year 3.

Definitions:

Q3: The periodic expense created by allocating the

Q24: A _ is a document explaining the

Q81: Consignment goods are:<br>A)Goods shipped by the owner

Q85: _ refers to the expected proceeds from

Q96: Discuss the period-end adjusting entries that are

Q172: The _ method uses both past and

Q175: _ are checks written by the depositor,deducted

Q187: Cost of Goods Sold is debited to

Q198: A company's net sales are $775,420,its costs

Q208: When evaluating the days' sales uncollected ratio,generally