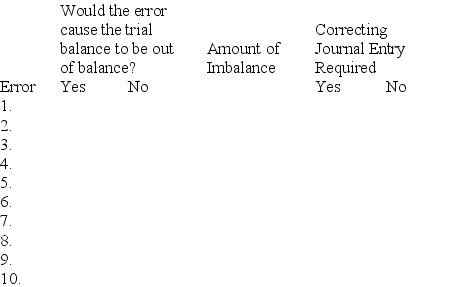

At year-end,Henry Laundry Service noted the following errors in its trial balance:

1.It understated the total debits to the Cash account by $500 when computing the account balance.

2.A credit sale for $311 was recorded as a credit to the revenue account,but the offsetting debit was not posted.

3.A cash payment to a creditor for $2,600 was never recorded.

4.The $680 balance of the Prepaid Insurance account was listed in the credit column of the trial balance.

5.A $24,900 van purchase was recorded as a $24,090 debit to Equipment and a $24,090 credit to Notes Payable.

6.A purchase of office supplies for $150 was recorded as a debit to Office Equipment.The offsetting credit entry was correct.

7.An additional investment of $4,000 by stockholders was recorded as a debit to Common Stock and as a credit to Cash.

8.The cash payment of the $510 utility bill for December was recorded (but not paid)twice.

9.The revenue account balance of $79,817 was listed on the trial balance as $97,817.

10.A $1,000 cash dividend was recorded as a $100 debit to Dividends and $100 credit to cash.

Using the form below,indicate whether each error would cause the trial balance to be out of balance,the amount of any imbalance,and whether a correcting journal entry is required.

Definitions:

Heart Disease

A range of conditions that affect the heart, including coronary artery disease, arrhythmias, heart failure, and others.

Thromboplastin

A plasma protein that plays a key role in the blood clotting process.

Clotting

The process by which blood changes from a liquid to a solid state, forming a clot to prevent excessive bleeding when vessels are injured.

Capillary Bed

A network of small blood vessels known as capillaries, which facilitate the exchange of oxygen, nutrients, and waste materials between the blood and tissues.

Q16: Under the alternative method for accounting for

Q50: Consolidated financial statements show the financial statements

Q64: A credit:<br>A)Always decreases an account.<br>B)Is the right-hand

Q70: Which of the following is NOT an

Q71: Comprehensive income refers to all changes in

Q74: A revenue account normally has a debit

Q172: Speedy has net income of $18,955,and assets

Q179: A record of the increases and decreases

Q191: _ expenses are those costs that are

Q280: Specific accounting principles are basic assumptions,concepts,and guidelines