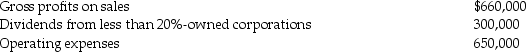

Carter Corporation reports the following results for the current year:

a)What is Carter Corporation's taxable income for the current year?

a)What is Carter Corporation's taxable income for the current year?

b)How would your answer to Part (a)change if Carter's operating expenses are instead $700,000?

c)How would your answer to Part (a)change if Carter's operating expenses are instead $760,000?

Definitions:

Depreciation Expense

The allocated portion of the total cost of a company's physical assets that is expensed out on the income statement over a set period, reflecting the asset's consumption and wear and tear.

Fixed Costs

Costs that do not change with the level of production or sales, including expenses like rent, salaries, and insurance.

Variable Cost

Expenses that change in proportion with production output or sales, such as materials and labor.

Fixed Costs

Costs that remain constant regardless of the amount of goods produced or sold, like lease payments, wages, and coverage fees.

Q5: What is a stock redemption? What are

Q32: Van owns all 1,000 shares of Valley

Q33: Frans and Arie own 75 shares and

Q44: All of Sphere Corporation's single class of

Q51: In 2010, Tru Corporation deducted $5,000 of

Q60: The future value of an ordinary annuity

Q65: Identify which of the following statements is

Q67: For corporations, what happens to excess charitable

Q73: Which of the following items are adjustments

Q88: Identify which of the following statements is