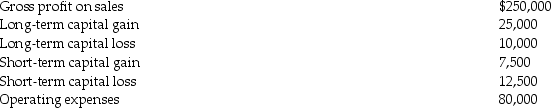

Westwind Corporation reports the following results for the current year:

What are Westwind's taxable income and regular tax liability before credits for the current year?

What are Westwind's taxable income and regular tax liability before credits for the current year?

Definitions:

Scope of the Project

The sum of all the project work and objectives to be achieved; this includes tasks, goals, deliverables, and constraints.

Managing Cash Flow

The process of monitoring, analyzing, and optimizing the net amount of cash receipts minus cash expenses.

Company's Money

The financial resources or capital belonging to a corporation, used for operational, investment, and strategic purposes.

Investments

The allocation of resources, such as time, money, or effort, in the expectation of achieving a future return or benefit.

Q8: Vanda Corporation sold a truck with an

Q21: Landers,Inc.,held 1,500 of Shipman Company common stock

Q29: Winter Corporation's taxable income is $500,000.In addition,

Q49: Dreyer Corporation purchased 5% of Willy Corporation's

Q52: Intercompany dividends and undistributed subsidiary earnings do

Q64: _ refers to all changes in equity

Q74: Mullins Corporation is classified as a PHC

Q97: Lake City Corporation owns all the stock

Q107: Upon formation of a corporation, its assets

Q115: Darnell, who is single, exchanges property having