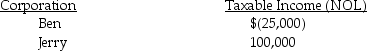

Ben and Jerry Corporations are members of the Ben-Jerry controlled group.The corporations file separate tax returns for the current year and report the following results:

a)If they elect no special apportionment plan, what is their combined tax liability?

a)If they elect no special apportionment plan, what is their combined tax liability?

b)If they DO elect a special apportionment plan, what is their lowest combined tax liability?

Definitions:

Sample Proportion

The sample proportion is a statistic that estimates the proportion of elements in a population that have a certain characteristic, based on a sample from that population.

Population Proportion

A measure that represents the fraction of members in a population that have a particular property or attribute.

Binomial Random Variable

A type of random variable that takes on a fixed number of trials, each with two possible outcomes.

Normal Curve

A symmetrical bell-shaped curve that describes the distribution of many types of data where most occurrences take place around the mean.

Q27: Island Corporation has the following income and

Q55: Dumont Corporation reports the following results in

Q67: Garcia Brass Fixtures is planning on replacing

Q70: Liquidation and dissolution have the same legal

Q73: Identify which of the following statements is

Q81: Explain the carryover provisions of the minimum

Q82: Jeremy operates a business as a sole

Q108: A citator is used to find<br>A) the

Q113: Discuss the IRS reporting requirements under Sec.351.

Q195: Weston Company had the following stock investments