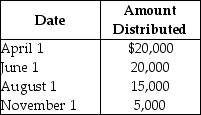

Payment Corporation has accumulated E&P of $19,000 and current E&P of $28,000.During the year, the corporation makes the following distributions to its sole shareholder:

The sole shareholder's basis in her stock is $45,000.What are the tax consequences of the June 1 distribution?

The sole shareholder's basis in her stock is $45,000.What are the tax consequences of the June 1 distribution?

Definitions:

Constitutional Amendment

is the process by which changes or additions are made to a constitution, allowing it to evolve with society's needs and values.

Chosen Separately

Indicates a selection process where decisions or selections are made independently of one another, often referring to how certain officials or elements within a system are selected without direct influence from others.

Bill Becomes Law

The process through which a proposed legislation, after being passed by both legislative houses and approved by the president or an equivalent authority, becomes legally effective.

President's Signature

The act of a president signing a document, often legislation passed by Congress, which then becomes law or an executive order put into immediate effect.

Q26: Abby owns all 100 shares of Rent

Q26: In a nontaxable reorganization, the acquiring corporation

Q34: Hogg Corporation distributes $30,000 to its sole

Q49: An advantage of filing a consolidated return

Q56: Which of the following actions cannot be

Q61: A consolidated NOL carryover is $52,000 at

Q66: Which of the following definitions of Sec.338

Q70: Identify which of the following statements is

Q95: Identify which of the following statements is

Q109: Corporate distributions that exceed earnings and profits