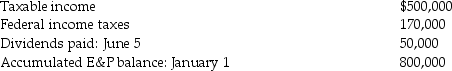

Lawrence Corporation reports the following results during the current year:

No dividends were paid in the throwback period.A long-term capital gain of $50,000 is included in taxable income.The statutory accumulated earnings tax exemption has been used up in prior years.An additional earnings accumulation of $60,000 for the current year can be justified as meeting the reasonable needs of the business.What is Lawrence Corporation's accumulated earnings tax liability?

No dividends were paid in the throwback period.A long-term capital gain of $50,000 is included in taxable income.The statutory accumulated earnings tax exemption has been used up in prior years.An additional earnings accumulation of $60,000 for the current year can be justified as meeting the reasonable needs of the business.What is Lawrence Corporation's accumulated earnings tax liability?

Definitions:

Federal Law

Legislation enacted by the national government or Congress that applies to the entire country.

Jurisdiction

The authority given to a legal body like a court to administer justice within a certain area of law or geographic territory.

Pleadings

Written statements filed with a court by parties to a legal dispute detailing their claims, defenses, and other legal arguments.

Notice

A formal communication informing someone of an action taken or to be taken, or a condition that affects legal rights or obligations.

Q9: A client wants to take a tax

Q14: Which of the following is not a

Q18: A liquidation must be reported to the

Q23: Corporations cannot use the installment method in

Q29: A new partner, Gary, contributes cash and

Q56: In a taxable distribution of stock, the

Q70: What are the five steps in calculating

Q86: Identify which of the following statements is

Q94: The minimum tax credit available for a

Q114: Grant Corporation is not a large corporation