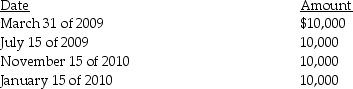

Jack has a basis of $36,000 in his 1,000 shares of Acorn Corporation stock (a capital asset).The stock was acquired three years ago.He receives the following distributions as part of a plan of liquidation of Acorn Corporation:

What are the amount and character of the gain or loss that Jack will recognize during 2009? During 2010?

What are the amount and character of the gain or loss that Jack will recognize during 2009? During 2010?

Definitions:

International Firms

Businesses that operate across national borders, engaging in international trade or investment.

International Firm

A company that engages in business activities across national borders.

Extension

In marketing, refers to expanding a product line or brand by introducing additional items or categories.

Marketing Strategy

The means by which a marketing goal is to be achieved, usually characterized by a specified target market and a marketing program to reach it.

Q47: Helmut contributed land with a basis of

Q48: Cactus Corporation, an S Corporation, had accumulated

Q53: Discuss the tax planning opportunities that are

Q59: When computing the accumulated earnings tax, which

Q67: The acquiring corporation does not obtain the

Q82: Jeremy operates a business as a sole

Q93: Identify which of the following statements is

Q96: The general business credit can be used

Q102: Foster Corporation has gross income for regular

Q108: Identify which of the following statements is