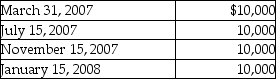

Sandy, a cash method of accounting taxpayer, has a basis of $46,000 in her 500 shares of Newt Corporation stock.She receives the following distributions as part of Newt's plan of liquidation.  The amount of the final distribution is not known on December 31, 2007.What are the tax consequences of the distributions?

The amount of the final distribution is not known on December 31, 2007.What are the tax consequences of the distributions?

Definitions:

Black Militant Art

Artistic expressions that emerged from the Black Power movement, advocating for racial pride, social justice, and resistance against oppression.

Assassination

The act of killing a prominent or important person, typically for political or ideological reasons.

Martin Luther King, Jr.

An American civil rights leader known for his nonviolent activism against racial segregation and for his pivotal role in advancing civil rights through speeches and protests during the 1950s and 1960s.

Rioting

A form of civil disorder characterized by the group violence against people or property.

Q18: In a nontaxable distribution of stock rights,

Q52: When computing E & P, Section 179

Q59: What is the tax impact of guaranteed

Q61: Eagle Corporation, a personal holding company, has

Q66: Which of the following items are tax

Q82: Ali, a contractor, builds an office building

Q84: Identify which of the following statements is

Q102: Lake Corporation distributes a building used in

Q109: Junod Corporation's book income is $500,000.What tax

Q119: Prince Corporation donates inventory having an adjusted