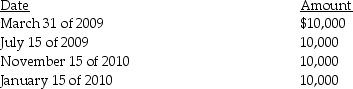

Jack has a basis of $36,000 in his 1,000 shares of Acorn Corporation stock (a capital asset).The stock was acquired three years ago.He receives the following distributions as part of a plan of liquidation of Acorn Corporation:

What are the amount and character of the gain or loss that Jack will recognize during 2009? During 2010?

What are the amount and character of the gain or loss that Jack will recognize during 2009? During 2010?

Definitions:

Preparation

The process of making ready or being made ready for use or consideration.

Implementation

The process of putting a plan or decision into effect.

360-degree Feedback

A performance appraisal method where an employee receives anonymous feedback from peers, subordinates, and supervisors, offering a comprehensive view of their performance.

Personality Analysis

The assessment of an individual's characteristics, traits, and behaviors to understand or predict their attitudes and actions in various settings.

Q2: Identify which of the following statements is

Q7: Susan owns 150 of the 200 outstanding

Q22: Raptor Corporation is a PHC for 2009

Q24: Identify which of the following statements is

Q25: Jerry has a 10% interest in the

Q27: Lynn transfers property with a $56,000 adjusted

Q33: How does the deduction for U.S.production activities

Q34: Hogg Corporation distributes $30,000 to its sole

Q37: Section 336 prevents recognition of a loss

Q90: Hydrangia Corporation reports the following results for