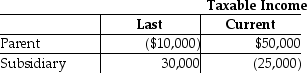

Parent and Subsidiary Corporations form an affiliated group.Last year, the initial year of operation, Parent and Subsidiary filed separate returns.This year, the group files a consolidated tax return.The results for last year and the current year are:  How much of Subsidiary's loss can be carried back to last year?

How much of Subsidiary's loss can be carried back to last year?

Definitions:

Speaker Attitude

The feelings or views that a speaker has towards the subject or audience, often conveyed through tone or choice of words.

Changing Representation

The dynamic process of how entities, ideas, or phenomena are depicted or regarded over time.

Problem Solving

The act or process of identifying a challenge or obstacle and finding solutions or methods to overcome it.

Envision

The act of imagining or anticipating something that has not yet occurred.

Q3: David purchased a 10% capital and profits

Q12: Exit Corporation has accumulated E&P of $24,000

Q13: In 2013, Lilly makes taxable gifts aggregating

Q42: Identify which of the following statements is

Q60: A partial liquidation of a corporation is

Q63: Bob exchanges 4000 shares of Beetle Corporation

Q65: Cactus Corporation, an S Corporation, had accumulated

Q71: Identify which of the following statements is

Q83: In a current distribution, the partner's basis

Q116: What are some of the advantages and