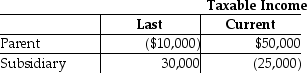

Parent and Subsidiary Corporations form an affiliated group.Last year, the initial year of operation, Parent and Subsidiary filed separate returns.This year, the group files a consolidated tax return.The results for last year and the current year are:  How much of Subsidiary's loss can be carried back to last year?

How much of Subsidiary's loss can be carried back to last year?

Definitions:

Involuntary Stable Single

A person's state of being single not by choice but due to circumstances that make changing this status difficult.

Remarried

The act of entering into marriage again after a divorce or the death of a spouse.

Wife Died

The occurrence of a spouse who is female passing away.

Defense of Marriage Act

A U.S. federal law enacted in 1996 that defined marriage for federal purposes as the union between one man and one woman, and allowed states to refuse to recognize same-sex marriages granted under the laws of other states. It was ruled unconstitutional in 2013.

Q2: When is E&P measured for purposes of

Q7: Last year, Cara contributed investment land with

Q23: Which one of the following special loss

Q29: A new partner, Gary, contributes cash and

Q41: Identify which of the following statements is

Q50: Identify which of the following statements is

Q75: What issues determine whether an affiliated group

Q90: A testamentary trust can be an S

Q99: Stan had a basis in his partnership

Q103: Jerry has a $50,000 basis for his