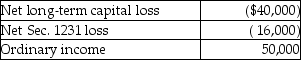

The XYZ Partnership reports the following operating results for the current year:  Tai has a 20% profits interest and a 25% loss interest in the XYZ Partnership.His distributive share of ordinary income is

Tai has a 20% profits interest and a 25% loss interest in the XYZ Partnership.His distributive share of ordinary income is

Definitions:

Corporate Debt

Financial obligations incurred by companies through borrowing, issuing bonds, or other financial instruments to support operations or growth.

Financial Leverage

The use of borrowed money (debt) to amplify the potential returns from an investment, increasing risk and potentially reward.

Financial Distress

A condition in which a company cannot generate the revenues or income necessary to meet its financial obligations, which may lead to bankruptcy.

MM Propositions

The Modigliani-Miller propositions, which are foundational theorems in corporate finance, asserting that under certain conditions, the value of a firm is unaffected by its capital structure.

Q24: Identify which of the following statements is

Q24: Mike and Jennifer form an equal partnership.Mike

Q26: Ameriparent Corporation owns a 70% interest in

Q39: The STU Partnership, an electing Large Partnership,

Q42: All corporations, except S corporations and small

Q50: Identify which of the following statements is

Q53: Barker Corporation, a personal service company, has

Q77: Type A reorganizations include mergers and consolidations.

Q91: Mia makes a taxable gift when she

Q97: What are the requirements for classifying a