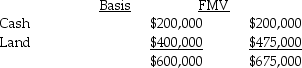

Sean, Penelope, and Juan formed the SPJ partnership by each contributing assets with a basis and fair market value of $200,000.In the following year, Penelope sold her one-third interest to Pedro for $225,000.At the time of the sale, the SPJ partnership had the following balance sheet:

Shortly after Pedro became a partner, SPJ sold the land for $475,000.What are the tax consequences of the sale to Pedro and the partnership (1)assuming there is no Section 754 election in place, and (2)assuming the partnership has a valid Section 754 election?

Shortly after Pedro became a partner, SPJ sold the land for $475,000.What are the tax consequences of the sale to Pedro and the partnership (1)assuming there is no Section 754 election in place, and (2)assuming the partnership has a valid Section 754 election?

Definitions:

Profit & Loss Statement

A financial statement that summarizes the revenues, costs, and expenses incurred during a specified period, typically a fiscal quarter or year.

Edit Pencil

This term likely refers to a tool or feature in software applications used for making amendments or corrections.

Enable Account Numbers

The process of assigning unique identifiers to accounts within an accounting system to facilitate organization and tracking.

Show Account Numbers

A functionality in software or systems that displays the numerical identifiers associated with specific accounts for easy reference.

Q22: The majority of the individual tax returns

Q32: Identify which of the following statements is

Q42: Explain the difference between partnership distributions and

Q58: Why should a corporation that is 100%

Q65: Chip and Dale are each 50% owners

Q70: In 1998, Delores made taxable gifts to

Q77: Moya Corporation adopted a plan of liquidation

Q79: When must a partnership make mandatory basis

Q84: Which of the following corporations is an

Q100: A split-interest gift transfer<br>A) involves two public