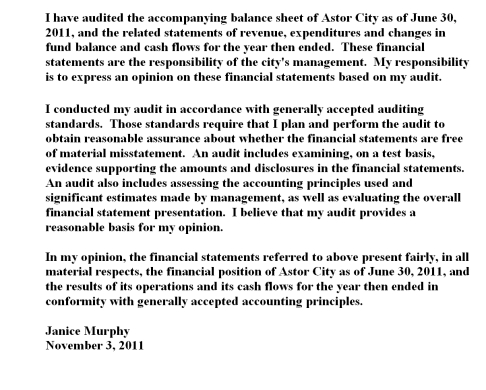

Astor City,a small city that is not required to have independent audit,voluntarily decided to have an audit of its financial records.Currently,the city generates $900,000 in revenues.Of the revenue generated,10% is from state sources and 2% is from federal sources.Janice Murphy,a CPA who serves on the city council has orally agreed to conduct the audit for a small gratuitous fee.Murphy decided not to accept a full fee since in the last three years she has gotten away from doing audit work and has concentrated her time on tax preparation and small business consulting.Murphy conducts the audit and presents the city with the following audit report:  Required

Required

(a)At a minimum what audit standards apply to Astor City (GAAS,GAS or Single Audit Act)? Why?

(b)Discuss any potential violations of the applicable audit standards.

Definitions:

Monthly Interest Rate

The interest rate applied to a loan or credit balance on a monthly basis.

Variable Cost

Expenses that vary in relation to the amount of product or service generated by a company.

Sales Price

The final amount of money charged for a product or service, or the value that consumers are willing to pay.

Optimal Point

The most favorable position or condition that yields the maximum benefit or efficiency in a given situation, such as in investment or production.

Q11: Describe what is meant by the term

Q13: Fiscal capacity is the government's ongoing ability

Q15: In the standard auditor's report for a

Q15: Would a not-for-profit library that receives the

Q26: "Generally accepted accounting principles include both those

Q40: The Financial Accounting Standards Board has the

Q44: Which of the following would properly be

Q56: Balanced scorecards integrate all of the following

Q82: Refer to Rhodes Bakery.Calculate the following

Q198: Use the following selected financial information