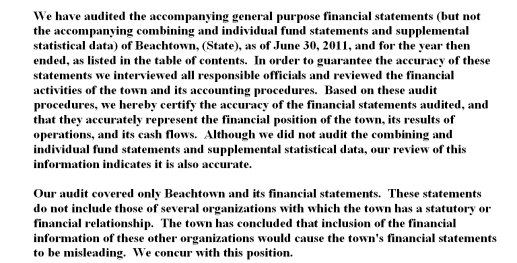

The following audit report was rendered on the financial statements of Beachtown:  Required:

Required:

Evaluate the extent to which this audit report conforms to that required by generally accepted auditing standards (GAAS).Identify areas of noncompliance with GAAS requirements that have been omitted.

Definitions:

Fiscal Year

A one-year period used for financial reporting and budgeting, which may or may not align with the calendar year.

Adjusting Entries

Journal entries made at the end of an accounting period to update income and expense accounts and ensure adherence to the accrual basis of accounting.

Adjusted Trial Balance

A record comprising all the accounts with their respective balances, revised after adjusting entries, employed in the preparation of financial documents.

Income Statement

A financial statement that shows a company's revenues and expenses over a specific period, culminating in a net profit or loss.

Q11: One of the primary purposes of the

Q19: Under current accounting and reporting standards nongovernmental,not-for-profit

Q24: Why do states and the federal government

Q34: Which of the following is required by

Q39: Not-for-profit organizations risk loss of their tax-exempt

Q40: Which of the following is a not

Q41: Business combinations can occur through either an

Q45: Culver City College,a public college,has a 10-week

Q50: An advantage of the equity method over

Q78: Which of the following is NOT a