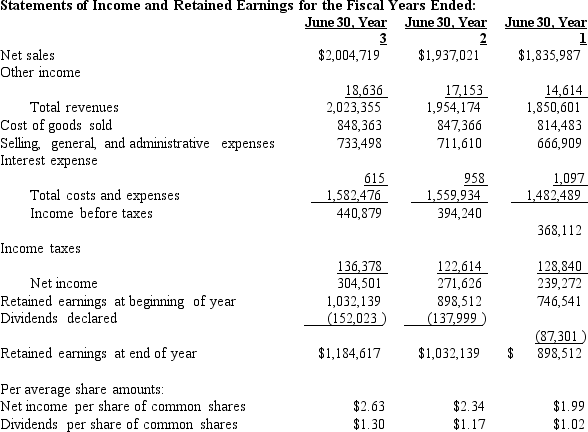

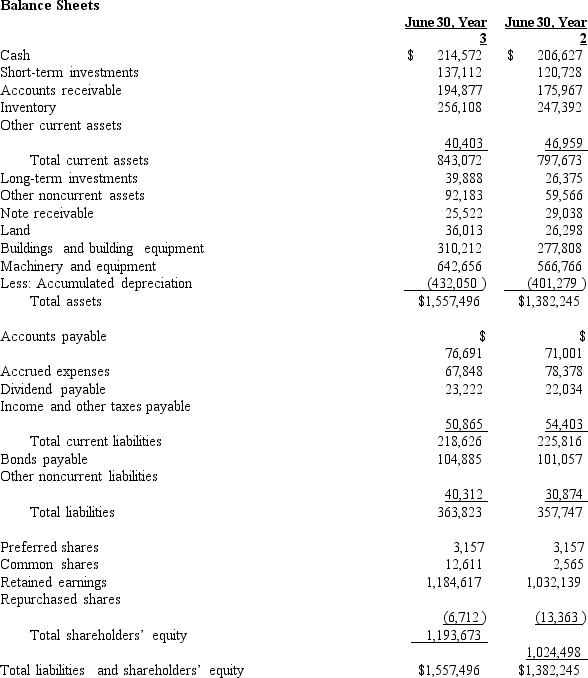

Comparative financial statements are provided below:

-Refer to Recovery Solutions,Inc.Evaluate the company's profitability ratios for Year 3 and Year 2,including the gross profit percentage,operating margin percentage,net profit margin percentage,return on assets,and return on equity.Assume that total assets and total shareholders' equity at June 30,Year 1 were $1,250,000 and 969,000,respectively.Also assume that the tax rate is 30% for all periods presented.

Definitions:

Deferred Tax Liability

A tax obligation owed by an entity in the future due to temporary differences between the book value of assets and liabilities and their tax value.

Income Tax Expense

The expense reported on the income statement that represents the amount of income tax a company owes to governmental authorities.

Tax Rate

The percentage at which an individual or corporation is taxed.

Lease Asset

An asset that is acquired under a lease agreement wherein the lessee has the right to use the asset for a specified period.

Q27: Bonds were initially issued at a discount.Under

Q29: The single audit requirement applies to<br>A)All audits

Q34: What are the benefits to a state

Q36: Which of the following is not a

Q37: Which of the following statements most accurately

Q39: All of the following characteristics may indicate

Q61: Governmental budgets must be made available for

Q83: Refer to the figure Company L.How much

Q183: The return on equity ratio measures the

Q224: dividend yield ratio<br>A)increase<br>B)decrease