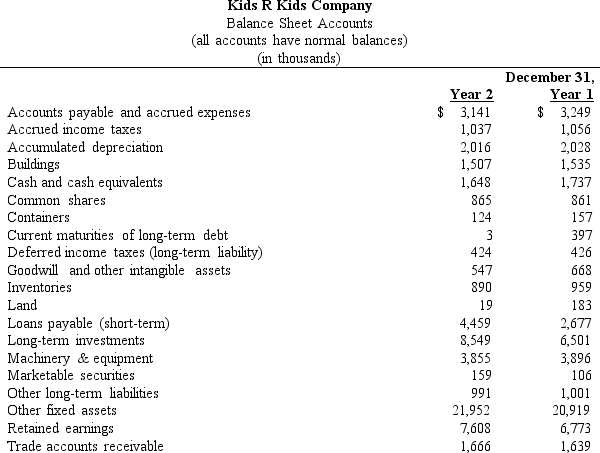

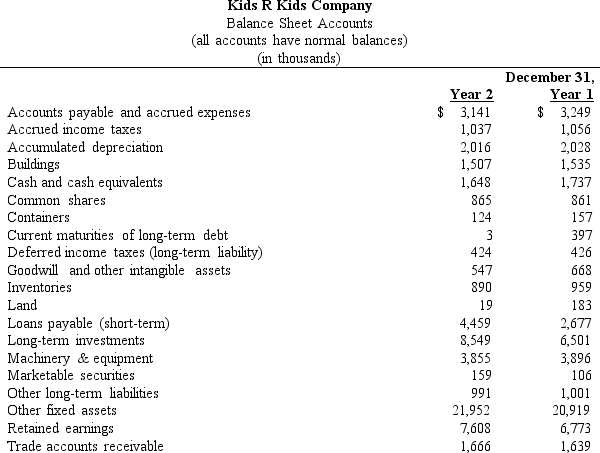

Kids R Kids Company

Selected data from the comparative financial statements are provided below:

Kids R Kids Company Income Statement Selected amounts (in thousands) Year ended December 31, Net sales Interest expense (all paid with cash) Income before income taxes Income taxes Net income Year 2$18,8132775,1981,6653.533 Year 1$18,8682586,0551,9264.129 Kids R Kids Company Income Statement Selected amounts (in thousands) Year ended December 31, Net cash provided by operating activities Financing activities: Cash dividends paid Purchase of treasury shares Issuance of debt Repayment of long-term debt Issuances of shares Year 2$3,433(1,480))(1,563)1,818(410)302 Year 1$4,033(1,387)(1,262)155(751)150

Kids R Kids Company Income Statement Selected amounts (in thousands) Year ended December 31, Net sales Interest expense (all paid with cash) Income before income taxes Income taxes Net income Year 2$18,8132775,1981,6653.533 Year 1$18,8682586,0551,9264.129 Kids R Kids Company Income Statement Selected amounts (in thousands) Year ended December 31, Net cash provided by operating activities Financing activities: Cash dividends paid Purchase of treasury shares Issuance of debt Repayment of long-term debt Issuances of shares Year 2$3,433(1,480))(1,563)1,818(410)302 Year 1$4,033(1,387)(1,262)155(751)150

-Refer to Kids R Kids Company.The interest coverage (accrual basis)ratio at December 31,Year 2,is:

Understand the benefits of early childhood care for specific groups.

Recognize leisure and work/activity disparities across socio-economic and racial groups.

Understand the multi-dimensional effects of poverty on well-being.

Understand the definitions and conceptual models of stress.

Definitions:

Accounting Equation

The foundation of double-entry bookkeeping, stating that Assets = Liabilities + Owners' Equity.

Excess Space

Excess space refers to the additional or unused space within a property or facility that exceeds the current needs of the occupants or users.

Materiality Constraint

An accounting principle that allows for the exclusion of insignificant financial information from reports because it would not impact decision-making.

Accounting Information

Data related to financial transactions and status of a business, used for analysis, decision making, and financial reporting.