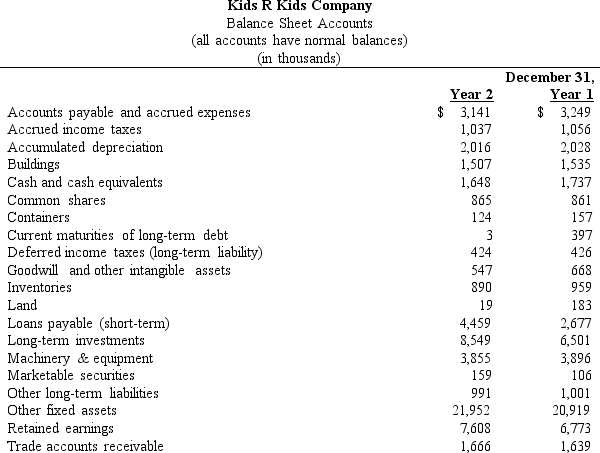

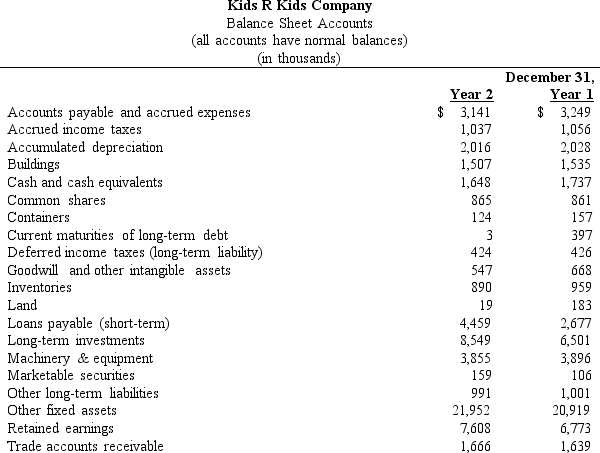

Kids R Kids Company

Selected data from the comparative financial statements are provided below:

Kids R Kids Company Income Statement Selected amounts (in thousands) Year ended December 31, Net sales Interest expense (all paid with cash) Income before income taxes Income taxes Net income Year 2$18,8132775,1981,6653.533 Year 1$18,8682586,0551,9264.129 Kids R Kids Company Income Statement Selected amounts (in thousands) Year ended December 31, Net cash provided by operating activities Financing activities: Cash dividends paid Purchase of treasury shares Issuance of debt Repayment of long-term debt Issuances of shares Year 2$3,433(1,480))(1,563)1,818(410)302 Year 1$4,033(1,387)(1,262)155(751)150

Kids R Kids Company Income Statement Selected amounts (in thousands) Year ended December 31, Net sales Interest expense (all paid with cash) Income before income taxes Income taxes Net income Year 2$18,8132775,1981,6653.533 Year 1$18,8682586,0551,9264.129 Kids R Kids Company Income Statement Selected amounts (in thousands) Year ended December 31, Net cash provided by operating activities Financing activities: Cash dividends paid Purchase of treasury shares Issuance of debt Repayment of long-term debt Issuances of shares Year 2$3,433(1,480))(1,563)1,818(410)302 Year 1$4,033(1,387)(1,262)155(751)150

-Refer to Kids R Kids Company.The interest coverage (cash basis)ratio at December 31,Year 2,is:

Definitions:

Direct Method

In cash flow reporting, a method that shows the specific sources and uses of cash, categorizing cash flows into operating, investing, and financing activities.

Net Cash Provided

The amount of cash generated by a company’s operations after accounting for all cash inflows and outflows.

Operating Activities

Activities that relate directly to the production, sale, and delivery of a company's products or services, affecting the net income.

Accumulated Depreciation

The total amount of a tangible asset's cost that has been allocated to depreciation expense since the asset was put into use.