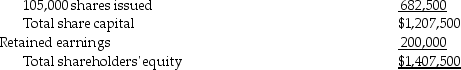

Given the following data for JetNew calculate the book value of a common share.

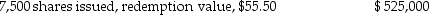

Share capital:

Preferred shares,30,000 shares authorized,

Common shares,200,000 shares authorized,

Common shares,200,000 shares authorized,

Next calculated the book value of a common share if the preferred shares are $5

Next calculated the book value of a common share if the preferred shares are $5

cumulative and have two years worth of dividend outstanding.

Definitions:

Depreciation Factory Building

This term relates to the allocation of the cost of a factory building over its useful life, reflecting its consumption and loss of value over time.

Direct Materials Used

Direct materials used are raw materials that are directly incorporated into a finished product and can be directly associated with the product.

Manufacturing Overhead Cost

Expenses related to the production process that cannot be directly attributed to individual products, such as factory rent, utilities, and maintenance.

Direct Materials Used

The cost of raw materials that are directly incorporated into a finished product during a specific period.

Q28: Discuss methods companies could use to increase

Q32: Profit is the total amount of money

Q35: _ make sure everyone is comfortable with

Q37: On an indirect method statement of cash

Q44: Key West Corporation,a public company determined its

Q53: The _ effect refers to the tendency

Q58: From the buyer's perspective,a discount on a

Q69: Companies with investments accounted for by the

Q97: _ is the total amount of money

Q105: Cash means more than just cash on