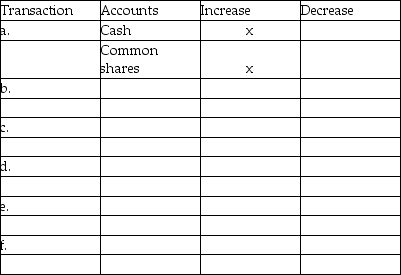

Analyze the following transactions.Indicate which accounts are affected and whether they will increase or decrease.Transaction (a)is completed as an example.

a.Owner investment of cash into the business.

b.Payment of a utility bill.

c.Purchase of inventory for cash.

d.Payment of an accounts payable.

e.Performing a service on account.

f.Collecting cash from a customer as payment on his account.

Definitions:

Grandchildren

The children of one's son or daughter.

Machine Time

The duration for which a machine is operated or available for use in the production of goods or services.

Professional Accounting Program

A formal education and training program designed to provide knowledge and skills necessary for accounting careers.

Retail Price

The total cost that consumers pay for a product in retail stores, including markups by retailers.

Q2: When recording the sale of property,plant,and equipment,the

Q11: What specific safety technique is always used

Q13: Given the following data,what is the cost

Q14: How is extravasation different from infiltration?<br>A) Infiltration

Q17: Which fraction represents the largest part of

Q18: An accounts receivable represents the promise of

Q24: The closing entry required to reset the

Q56: What will be the result if no

Q104: Paying a utility bill when received would:<br>A)

Q134: Prepare adjusting journal entries dated December 31