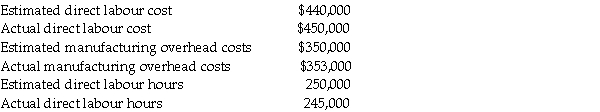

Wisteria Company is debating the use of direct labour cost or direct labour hours as the cost allocation base for allocating manufacturing overhead.The following information is available for the most recent year:

Determine the following:

A)Predetermined manufacturing overhead rate using direct labour cost as the allocation base

B)Predetermined manufacturing overhead rate using direct labour hours as the allocation base

C)Allocated manufacturing overhead costs based on direct labour cost for the year

D)Allocated manufacturing overhead costs based on direct labour hours for the year

Definitions:

Producer Surplus

The difference between the amount producers are willing to supply goods for and the actual amount received by them when sold.

Perfectly Competitive Industry

An economic theory describing a market structure where firms sell identical products, no single buyer or seller can influence the market price, and information is freely available.

AC

AC, or Average Cost, is the cost per unit of output, calculated by dividing the total cost by the quantity of output produced.

Consumer Surplus

The difference between what consumers are willing to pay for a good or service and what they actually pay, reflecting the economic benefit to consumers.

Q1: Sanjay Company's total sales revenue will be<br>A)$160,000.<br>B)$120,000.<br>C)$112,000.<br>D)$8,000.

Q29: Custom Cedar Products (CCP)manufactures a line of

Q52: Preparing financial statements in accordance with GAAP

Q92: In a process costing environment,direct materials and

Q99: Custom Cedar Products (CCP)manufactures a line of

Q106: A company uses a process system.The number

Q123: Rhapsody Corporation manufactures several different products and

Q138: Here are selected data for Fritzel Company:<br><img

Q193: A company manufactures exterior paint.Last month's costs

Q240: On a production cost report,current costs added