Humber Products manufactures its products in two separate departments: milling and assembly.Total manufacturing overhead costs for the year are budgeted at $2 million.Of this amount Milling Department incurs $1,200,000 (primarily for machine operation and depreciation)while the Assembly Department incurs $800,000.Humber Products estimates that it will incur 8,000 machine hours (all in the Milling Department)and 25,000 direct labour hours (5,000 in the Milling Department and 20,000 in the Assembly Department)during the year.

Humber Products currently uses a plant-wide overhead rate based on direct labour hours to allocate overhead.However,the company is considering refining its overhead allocation system by using departmental overhead rates.The Milling Department would allocate its overhead using machine hours (MH),but the Assembly Department would allocate its overhead using direct labour (DL)hours.

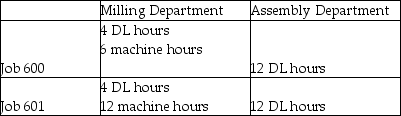

The following chart shows the machine hours (MH)and direct labour (DL)hours incurred

by Jobs 600 and 601 in each production department:

Both Jobs 600 and 601 used $2,000 of direct materials.Wages and benefits total $25 per direct labour hour.Humber Products prices its products at 110% of total manufacturing costs.

Required:

1.Compute Humber Products' current plant-wide overhead rate.

2.Compute refined departmental overhead rates.

3.Compute the total amount of overhead allocated to each job if Humber Products uses its current plant-wide overhead rate.

4.Compute the total amount of overhead allocated to each job if Humber Products uses departmental overhead rates.

5.Do both allocation systems accurately reflect the resources that each job used? Explain.

6.Compute the total manufacturing cost and sales price of each job using Humber Products' current plant-wide overhead rate.

7.Compute the total manufacturing cost and sales price of each job using Humber Products' refined departmental overhead rates.

8.Based on the current (plant-wide)allocation system,how much profit did Humber Products think it earned on each job?

9.Based on the departmental overhead rates and the sales price determined in Requirement 7,how much profit did it really earn on each job?

Definitions:

Cleaning Products

Substances used for removing dirt, stains, bad smells, and clutter on surfaces to maintain a clean and safe environment.

Personal Care Products

Items used for personal hygiene and beautification, such as soap, shampoo, and cosmetics.

Promotional Strategy

A marketing approach that combines various communication tools and tactics to increase awareness, create interest, and drive sales of a product or service.

Devalue

To reduce or underestimate the importance, value, or worth of something or someone, often affecting perception and market positioning.

Q80: The Assembly Department of Watts Speakers began

Q82: What was the amount allocated for manufacturing

Q128: The last step of the 5-step process

Q135: All costs contain both a fixed and

Q160: The journal entry needed to record depreciation

Q193: If Sable Company uses direct labour cost

Q198: If production increases by 15%,how will total

Q204: At the end of the period,what are

Q249: Broadline Ltd.uses the weighted-average method of process

Q253: Daniel Company uses a job cost system.The