Speedy Machine Products manufactures its products in two separate departments,Machining and

Painting.Total manufacturing overhead costs for the year are budgeted at $2,500,000.Of this amount the Machining Department incurs $1,500,000 (primarily for machine operation and depreciation)while the Painting Department incurs $1,000,000.Speedy Machine Products estimates that it will incur 12,000 machines hours (all in the Milling Department)and 40,000 direct labour hours (15,000 in the Milling Department and 25,000 in the Assembly Department)during the year.

Speedy Machine Products currently uses a plant-wide overhead rate based on direct labour hours

to allocate overhead.However,the company is considering refining its overhead allocation

system by using departmental overhead rates.The Machining Department would allocate its

overhead using machine hours (MH),but the Painting Department would allocate its

overhead using direct labour (DL)hours.

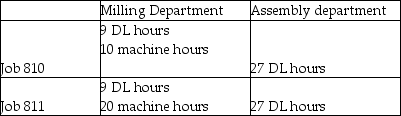

The following chart shows the machine hours (MH)and direct labour (DL)hours incurred

by Jobs 810 and 811 in each production department:

Both Jobs 810 and 811 used $7,500 of direct materials.Wages and benefits total $30 per direct labour hour.Speedy Machine Products prices its products at 120% of total manufacturing costs.

Required:

1.Compute Speedy Machine Products' current plant-wide overhead rate.

2.Compute refined departmental overhead rates.

3.Compute the total amount of overhead allocated to each job if Speedy Machine Products uses its current plant-wide overhead rate.

4.Compute the total amount of overhead allocated to each job if Speedy Machine Products uses departmental overhead rates.

5.Do both allocation systems accurately reflect the resources that each job used? Explain.

6.Compute the total manufacturing cost and sales price of each job using Speedy Machine Products' current plant-wide overhead rate.

7.Compute the total manufacturing cost and sales price of each job using Speedy Machine Products' refined departmental overhead rates

8.Based on the current (plant-wide)allocation system,how much profit did Speedy Machine Products think it earned on each job?

9.Based on the departmental overhead rates and the sales price determined in Requirement 7,how much profit did it really earn on each job?

Definitions:

Logistics Customer Service

Part of the supply chain management that plans, implements, and controls the efficient, effective forward and reverse flow and storage of goods, services, and related information between the point of origin and the point of consumption in order to meet customer's requirements.

Marketing Perspective

An approach to business focusing on understanding and satisfying the needs and wants of customers through market research and strategic promotion.

Customer Relationship Management

A strategy for managing an organization's interactions with current and future customers, using data analysis about customers' history with a company to improve business relationships.

Stockout

A situation where inventory is exhausted and items are unavailable for sale or use, often resulting in lost sales or delays.

Q11: It is easier to allocate indirect costs

Q11: Adjusting of cost of goods sold for

Q14: Companies should always use job costing rather

Q20: Total costs for Watson & Company at

Q45: What are the total equivalent units for

Q99: Hinckley & Granger Company had the following

Q215: Assume no beginning WIP inventory.The ending WIP

Q229: Both process and job costing assign costs

Q255: An underallocation of manufacturing overhead is typically

Q273: The Clauson Company fixed cost per unit