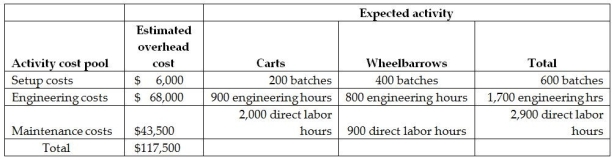

Vittoria Corporation manufactures two products-Carts and Wheelbarrows.The annual production and sales of Carts is 2,000 units,while 1,800 units of Wheelbarrows are produced and sold.The company has traditionally used direct labour hours to allocate its overhead to products.Carts require 1.0 direct labour hours per unit,while Wheelbarrows require 0.5 direct labour hours per unit.The total estimated overhead for the period is $117,500.The company is looking at the possibility of changing to an activity-based costing system for its products.If the company used an activity-based costing system,it would have the following three activity cost pools:

The predetermined overhead allocation rate using the traditional costing system would be closest to

Definitions:

Ten Commandments

A set of biblical principles relating to ethics and worship, playing a fundamental role in Christianity and Judaism.

Listening

The active process of receiving, interpreting, and responding to verbal and nonverbal messages.

Nonverbal Communication

Transmission of information or messages without the use of words; includes gestures, body language, facial expressions, and other visual cues.

Vocabulary

The range of words known and used by a person in particular contexts or languages.

Q5: Bond Industries uses departmental overhead rates to

Q27: Hollinger Ceramics makes custom ceramic tiles.During March,the

Q130: Second or subsequent departments must account for

Q172: Computing the predetermined manufacturing overhead rate is

Q206: Using the high-low method,what is the variable

Q236: At Harbour Manufacturing what is the total

Q240: If the Garrett Company allocates overhead based

Q269: When graphing total variable costs,the cost line

Q271: Job costing systems accumulate the costs for

Q314: In the equation y = $9.90x +