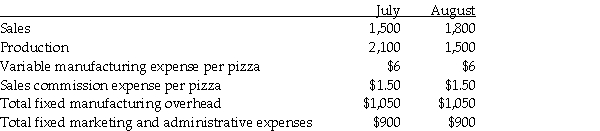

Andréa's Bakery produces frozen pizzas,which it sells for $10 each.The company uses the FIFO inventory costing method and it computes a new monthly fixed manufacturing overhead rate based on the actual number of meals produced that month.All costs and production levels are exactly as planned.The following data are from Andréa's Bakery first two months in business:

Required:

1.Compute the product cost per meal produced under absorption costing and under variable costing.Do this first for July and then for August.

2.Prepare separate monthly income statements for July and for August,using (a)absorption costing and (b)variable costing.

3.Is operating income higher under absorption costing or variable costing in July? In August? Explain the pattern of differences in operating income based on absorption costing versus variable costing.

Definitions:

W-3

A tax form used in the United States to transmit wage and tax information from employers to the Social Security Administration.

Transmittal

The process or document involved in sending something from one person or place to another.

FICA-OASDI

Federal Insurance Contributions Act - Old Age, Survivors, and Disability Insurance, a U.S. payroll tax funding Social Security.

FUTA

Stands for Federal Unemployment Tax Act, which imposes a payroll tax on employers to help fund state workforce agencies.

Q21: American Corporation currently sells its products for

Q52: Which of the following is the starting

Q60: Which of the following is the factor

Q91: Dover Industries management has budgeted the following

Q121: Managers often approximate curvilinear costs and step

Q129: Assuming Accessibility Products Company drops model F

Q144: Costs of ending WIP inventory are not

Q154: TK Electronics is a manufacturer with two

Q180: If Rosemont Tennis is a price-taker and

Q275: Using the high-low method,the monthly operating costs-if